Why and where shoud I start with Bitcoin?

Introduction to Bitcoin: LiberBits' Publishing Focus

At LiberBits, our publishing efforts center on the emergence and accelerating adoption of Bitcoin. Invented through decades of advancements in cryptography and computer science, Bitcoin has evolved in just over a decade from its 2009 launch into an indestructible, antifragile decentralized peer-to-peer (P2P) monetary network. With a strictly capped supply of 21 million BTC, it is widely regarded as programmable, dematerialized gold tailored for the internet and digital age. While gold has historically served as sound money primarily for the elite, Bitcoin promises to be sound money for everyone worldwide in the future.

Billions of people globally lack access to reliable financial services and endure unstable, depreciating fiat currency regimes. Bitcoin, as an open-source public network with a predefined, transparent sound money policy, is accessible to anyone with a smartphone and internet connection. Starting with a simple Bitcoin wallet app makes it easy to use the network for payments and savings.

Growing Advocacy from Legendary Investors

Increasingly, prominent traditional investors such as Stanley Druckenmiller and Paul Tudor Jones are championing long-term Bitcoin investments as a means to preserve and build wealth amid economic uncertainties. Michael Saylor, CEO of MicroStrategy, demonstrates a deep grasp of this new asset class and its broader implications for Bitcoin adoption.

Saylor draws inspiration from Ross Stevens, CEO of the New York Digital Investment Group (NYDIG). NYDIG is pioneering an inclusive financial system, positioning Bitcoin as a universal option for billions globally. As a resource for human progress, Bitcoin enables NYDIG to serve as a gateway for financial institutions, including banks. In the U.S., banks now have regulatory approval to integrate Bitcoin services alongside traditional offerings.

Bitcoin's Role in the Global Financial Landscape

As a novel asset class, Bitcoin competes for market share in inflation hedges and stores of value, a sector with an estimated global value exceeding $500 trillion (encompassing real estate, gold, bonds, and other commodities with monetary premiums). Banking services are increasingly being built on the Bitcoin technology stack, while decentralized finance (DeFi) applications challenge the traditional banking sector. Intriguingly, Bitcoin is gaining adoption not only among individual investors but also within banks themselves.

We encourage readers to explore this perspective further by listening to Ross Stevens' insightful interview on "The Beauty of Bitcoin," where he discusses its potential to foster a fairer monetary system.

The Urgent Need for Digital Gold

In today's monetary environment—marked by unchecked debt creation, negative-yielding bonds, low or negative interest rates, inflation, and currency devaluations—there is a pressing demand for unconfiscatable digital property in cyberspace. Bitcoin emerges as a decentralized alternative to central banking, offering transformative savings technology and an absolutely scarce digital asset. As an emerging asset class, it is increasingly utilized as an inflation hedge and strategic reserve by investors and corporations, positioned alongside real estate, gold, and commodities like oil.

Bitcoin is often viewed as a credit default swap (CDS) on failing national monetary policies and central banks—a hedge against systemic risks in fiat systems. For deeper insights, explore why Bitcoin functions as a CDS.

The Paradigm Shift: Preserving Human Time and Wealth

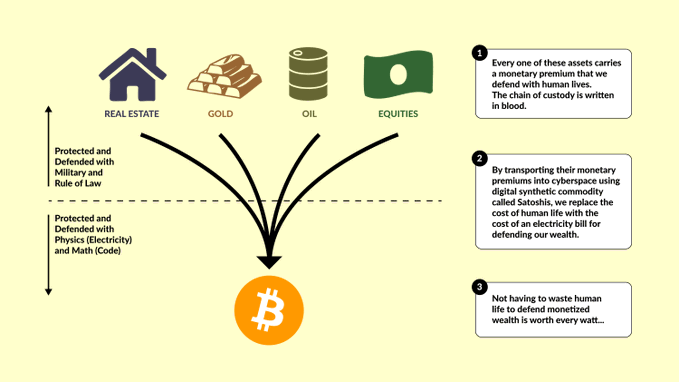

Traditional stores of value carry monetary premiums historically defended at the cost of human lives, upheld by military might and the rule of law. Their chains of custody are etched in blood.

Bitcoin disrupts this by absorbing these monetary premiums into cyberspace through a digitally scarce synthetic commodity. It replaces the human cost of defense with the expense of electricity, secured by physics (energy) and mathematics (code).

Bitcoin's invention heralds profound implications for our financial future—a mind-blowing, unprecedented paradigm shift in monetary history that we are all now witnessing. The chart below illustrates how Bitcoin is poised to disrupt the monetary use cases of other asset classes, collectively valued at approximately $500 trillion (visualizing absorption from gold, real estate, bonds, and more into Bitcoin's ecosystem).

How Should I Start with Bitcoin?

Getting started with Bitcoin offers numerous pathways, but selecting a trustworthy exchange is crucial. LiberBits has curated a list of top exchanges suitable for beginners and advanced traders alike. We recommend opening accounts with one or two of these to compare features:

- Bitvavo Exchange - Amsterdam

Bitvavo is a premier European cryptocurrency exchange with trading fees up to 0.25%. Its user-friendly simple and advanced interfaces make digital assets accessible at competitive prices. Trusted by brokers and institutions, Bitvavo was among the first in Europe to offer insured cold storage. Committed to regulatory compliance, innovation, and security, it operates data centers certified to ISO 9001, ISO 27001, ISO 27017, PCI DSS Level 1, and SOC 1-3 standards. Clients benefit from an Account Guarantee reimbursing up to €100,000 in case of unauthorized access. As of 2025, Bitvavo holds a MiCA license, enhancing its operations across the EU. For more: Visit Bitvavo. - Bybit Exchange - Global (Dubai HQ) Bybit is a fast-growing cryptocurrency exchange offering spot, futures, and derivatives trading with low fees and high liquidity. It supports over 1,000 cryptocurrencies and features like copy trading and NFT marketplace. Security measures include cold wallet storage, multi-signature withdrawals, and proof-of-reserves audits. In late June 2025, Bybit secured a MiCA license, enabling full EU operations and emphasizing compliance. User funds are protected via segregated accounts, but no FDIC-style insurance. For more: Visit Bybit.

- Binance Exchange - Global Binance extends beyond a leading exchange to a full ecosystem, including spot and futures markets, DEX, P2P trading, savings, debit cards, lending, staking, research, and more. While feature-rich, customer service can vary. In 2025, Binance has pursued MiCA compliance for its EU entity, aligning with regional expansions. Security includes SAFU fund for user protection, though not traditional insurance. For more: Visit Binance.

- Kraken Exchange - San Francisco

One of the oldest and largest Bitcoin exchanges, Kraken excels in service, low fees, diverse funding options, and stringent security. It operates through EU entities like Payward Europe Solutions Limited for VASP services. In June 2025, Kraken obtained a MiCA license in Ireland, allowing expanded EU services. While not insured like a bank (no FDIC/SIPC coverage), it safeguards assets per regulatory standards. For more: Visit Kraken. - Bitfinex Exchange - Global

The longest-running major cryptocurrency exchange since 2012, Bitfinex offers advanced trading tools, innovative tech, and superior customer service for traders and institutions. It focuses on security through cold storage and multi-signature wallets. As of 2025, Bitfinex has not highlighted MiCA licensing in public updates, operating globally with various jurisdictional compliances. For more: Visit Bitfinex. - Gemini Exchange - New York & London As a licensed New York trust company, Gemini undergoes regular bank exams and cybersecurity audits by the New York Department of Financial Services. It holds SOC 1 Type 1 and SOC 2 Type 2 compliance—the first crypto exchange and custodian to achieve this. All online crypto is insured, with best-in-class cold storage coverage from leading providers. In 2025, Gemini continues to emphasize U.S. regulatory compliance but has not publicly announced a MiCA license. For more: Visit Gemini.

- Bitstamp Exchange by RobinHood - Luxemburg Operating since 2011 with an EU payment institution license, New York BitLicense, and Big Four audits, Bitstamp prioritizes offline asset storage, BitGo insurance, and additional crime coverage for online wallets. Security is paramount, making it a reliable choice for institutional clients. By mid-2025, Bitstamp has secured MiCA compliance through its EU operations. For more: Visit Bitstamp.

- OKX Exchange - Global (Seychelles HQ)

OKX is a comprehensive crypto platform with spot, futures, margin trading, staking, and Web3 wallet integration, supporting hundreds of assets. It boasts low fees, advanced charting, and a large user base. Security features cold storage, two-factor authentication, and regular audits. As of June 2025, OKX obtained a MiCA license, facilitating EU market access and regulatory adherence. It maintains a proof-of-reserves program but lacks traditional deposit insurance. For more: Visit OKX. - Hodl Hodl P2P Exchange - Decentralized

Hodl Hodl enables direct peer-to-peer Bitcoin trading without holding user funds—instead using multisig escrow to minimize theft risks and speed transactions. Free from complex compliance, it allows anonymous trades between wallets worldwide, supporting any payment method and currency. As a non-custodial platform, it emphasizes decentralization and privacy with no KYC requirements. For more: Visit Hodl Hodl. - Bisq DEX - Decentralized

Bisq is an open-source, peer-to-peer decentralized exchange for buying and selling Bitcoin with fiat or other cryptocurrencies. It runs on a desktop app, ensuring no central servers or custodians—trades are atomic and secured via multisig escrow and arbitration. Privacy-focused with no registration or KYC, it supports global payment methods. As of 2025 (latest version v1.9.21), it remains fully decentralized without traditional licenses like MiCA, prioritizing user sovereignty. For more: Visit Bisq. - Saturn Bitcoin DEX - Decentralized

Saturn is a Bitcoin-native decentralized exchange built on the base layer, enabling trustless AMM swaps, liquidity pools for Runes, and on-chain order books. It allows direct asset trading without intermediaries, leveraging Bitcoin's security model. Non-custodial and open-source, it focuses on decentralization with no KYC or central control. Launched in 2024, by 2025 it continues to expand Rune liquidity features without pursuing centralized licenses like MiCA. For more: Visit Saturn.

Avoid Trading: Embrace DCA and HODL

Next, prioritize learning about Bitcoin over speculative trading unless you're a professional. LiberBits advises adopting a dollar-cost averaging (DCA) strategy to accumulate BTC steadily. DCA involves investing a fixed amount (e.g., €100 weekly) into Bitcoin at regular intervals, mitigating risks from market peaks for long-term holders.

Invest only savings you can commit long-term, and consider partial sales during cycle highs. We discourage buying other crypto assets initially—focus on education rather than speculation. LiberBits recommends the following Bitcoin educational resources:

Educational sources:

- The Bitcoin Beginner's Guide - Podcast series on Bitcoin of Peter McCormack

- Unchained Capital - Blog with great content on Bitcoin's value proposition.

- Saifedean Ammous - Educational content of the writer of the Bitcoin Standard. A masterpiece on financial history and bitcoin.

- Robert Breedlove - Bitcoin educator with fantastic content on bitcoin.

- Microstrategy on Bitcoin - collection of the best video's and content of bitcoin's value proposition.

- Einfach Bitcoin - German site on bitcoin with great content for the German readers.

- Beste Bank - Dutch reference site on bitcoin content and resources with a free bitcoin course.

- Bitcoin Gids - Dutch reference site on exchange reviews.

This information is not investment advice. Do you own due diligence before investing in bitcoin.